Our Fund

Elite Global Equity Fund

The Fund has a charter to support project financing in the ESG space but is open to investments in a variety of sectors that incorporate ESG values, including infrastructure, energy, agriculture, advanced technology, and real estate. Its focus on ESG strategic investments is supported by accessing the global capital markets using its brokerage/platform accounts, working with several banking partners and institutional financiers to structure project financing.

Corporate Structure

Elite Crown Limited is the parent company of the group and holds diverse businesses focused on making an impact on ESG values. The Fund is a fully regulated entity registered with the Cayman Islands Monitory Authority (CIMA) and has a US Delaware domiciled entity, Elite Global Equity, LLC that is a feeder to several Special Purpose Entities (SPEs) where structured project financing is deployed. Elite’s regulated platform accounts are held in multiple financial institutions and the Fund acts as a diversified asset manager providing comprehensive project financing and asset management services to its investment partners. It also holds a unique structure where the AUM is leveraged to secure financing for its controlled verticals, offering an active model investment portfolio of projects where capital can be deployed.

ELITE

ECO_nomic

MODEL

For over 15 years, the management team has been focused on project financing using traditional debt/equity structures. The team delivered and operated micro-utility solutions, solar power purchase agreements, charging systems, and turnkey energy storage systems for industrial and commercial customers.

The portfolio of renewable energy projects grew to a national scale, where the competitive differentiator was the company’s financing structure that used an off-balance-sheet capital stack, utilizing tax credits, state and federal incentives, owner equity and debt/equity contributions from private investors. The model saved millions of dollars in project costs and provided the lowest cost of capital in the market for project development, allowing customers to finance renewables energy generation and save on their electricity costs.

Elite’s management expended on power purchase agreements by broadening the scope to 20+ year annuities that are supported by the Fund. The model brought about a mechanism to create structured financing by leveraging all aspects of administration, engineering, procurement, construction, operations, maintenance, and asset management under one platform, which we today call the “ECO_nomic” model for financing.

Investment Management

The Fund’s investment management team is a group of seasoned directors, officers and advisors who come from diverse market sectors, including renewable energy, real estate, finance, legal, and government relations. As a regulated entity, the Fund has appointed Auditors and Administrators who oversee the Fund’s activities, and a board of independent advisors steer the direction of its overall strategy and investment portfolio. The Fund aims to be a global leader in leveraged financing, delivering attractive returns through innovative approaches in the alternative investment space.

Investment Management

The Fund’s investment management team is a group of seasoned directors, officers and advisors who come from diverse market sectors, including renewable energy, real estate, finance, legal, and government relations. As a regulated entity, the Fund has appointed Auditors and Administrators who oversee the Fund’s activities, and a board of independent advisors steer the direction of its overall strategy and investment portfolio. The Fund aims to be a global leader in leveraged financing, delivering attractive returns through innovative approaches in the alternative investment space.

Fund Activities and Mitigating Risk

Elite allows qualified investors to enter subscriptions by placing Funds Under Management (FUM) and/or Assets Under Management (AUM), which can be placed with Elite’s banking/custody partners in separately managed accounts (SMAs). Where necessary, Elite can also initiate a Security Trust Agreement to have the FUM/AUM held by an independent custodian, and the SMAs can be accessed by clients on Elite’s platform 24/7. The Fund can hold FUM/AUM in a nondepleting manner depending on the type of subscription entered with the client.

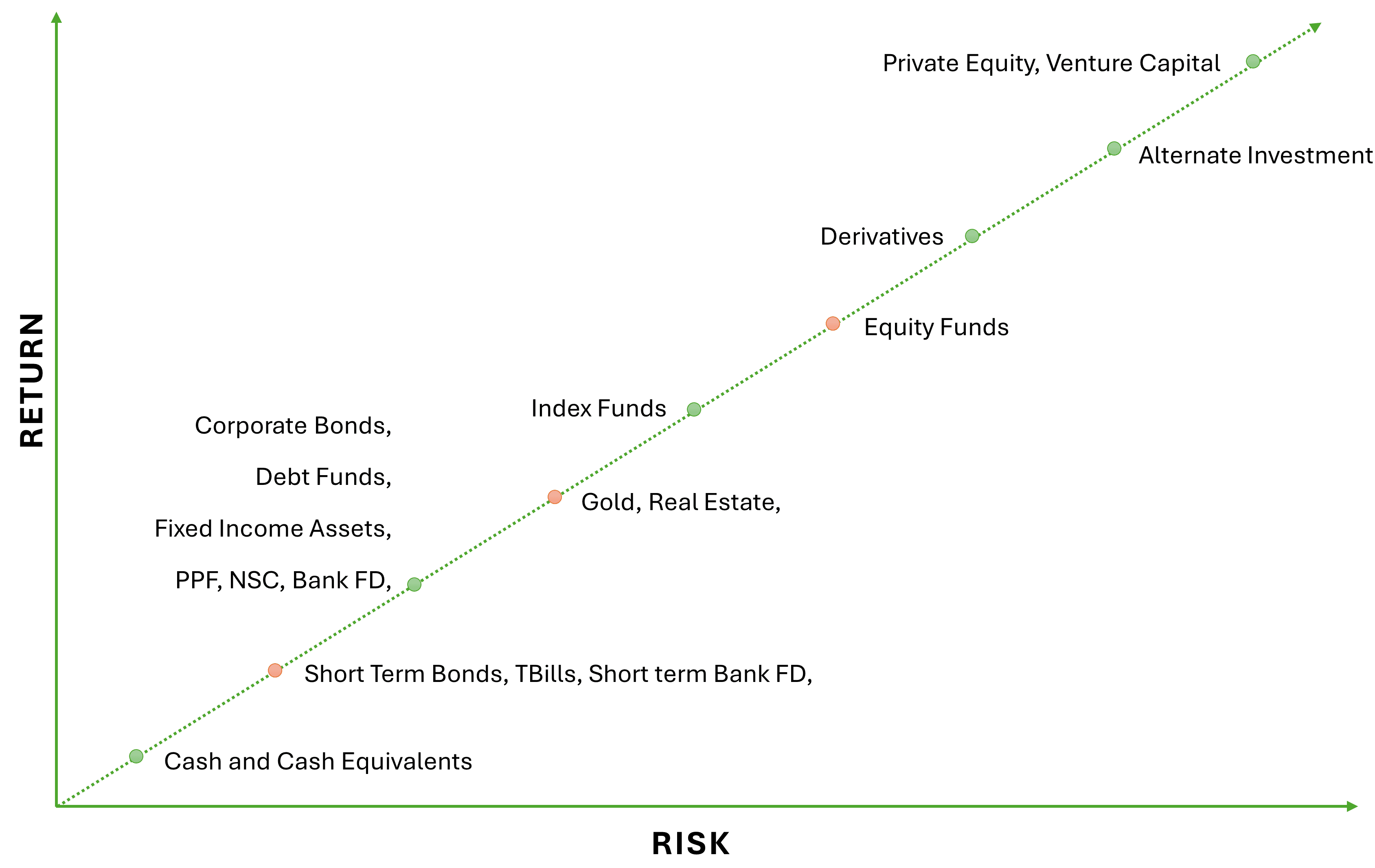

The Fund has exposure to both traditional and non-traditional alternative financial products, focused on generating stable investment income by providing diversified coverage to domestic and global corporate debt and credit market securities. The Fund actively searches and secures mispriced assets at a discount opportunistically and secures yield from its internal investments and external activities. Global corporate debt and credit markets typically offer higher income than traditional fixed interest and equity markets, so the Fund leverages its balance sheet to secure such securities to improve the risk-return profile over a multi-asset investment portfolio. Additionally, internally controlled investments into operating verticals provide a buffer to offset fluctuations in performance.

The FUM and AUM are reflected on the balance sheet and can be leveraged to secure project financing capital. Investors are provided an Information Memorandum and Prospectus outlining the strategy and mandate of the activities used by the Fund. The Fund can perform trading activities and can involve dynamic convergence of technology-based solutions to identify opportunities, and it can provide back and front office support services to secure yields for its clients. Using its platform accounts, the Fund provides investment services with full-service management of client’s portfolios.

This unique structure provides an exciting value proposition utilizing financing practices that were developed by management in financing renewable energy projects over the past decade. Management had leveraged project assets to create debt instruments to grow new project portfolios for decades and now utilize this structure to enhance its investment portfolio. The financing structure is designed to provide alternative sources of lower-cost capital for project financing without taking unintended risks and keeping stakeholders at ease until a project can cash flow.

Anti Money Laundering and KYC

Elite abides by the Federal Financial Institutions Examination Council’s (FFIEC) Bank Secrecy Act/Anti-Money Laundering (AML) compliance requirements and has system of internal controls to assure ongoing compliance and monitoring. It implements a risk-based customer identification program that evaluates beneficial ownership requirements and the origin of funds it manages as per the regulations issued by Financial Crimes Enforcement Network. The Know Your Client (KYC) is a key component of the AML program, broadly covering how we align with customers to uncover money laundering across the enterprise and vet customer relationships to identify and report suspicious transactions and, on a risk basis, to maintain and update customer information.